The mining industry in South Africa has long been a cornerstone of the country’s economy, contributing significantly to its GDP and employment. With a rich history of mineral extraction, South Africa is home to a variety of mines that produce gold, platinum, diamonds, and other valuable resources. As the global demand for minerals continues to fluctuate, potential investors are increasingly interested in the availability of mines for sale. This article will explore the current state of the mining industry in South Africa, examine available mines for sale, discuss the factors influencing these sales, and provide guidance on navigating the mine purchase process. Additionally, we will introduce SBM Company, a leading provider of crushers, mills, and other heavy industrial equipment essential for mining operations.

The South African mining industry is currently experiencing a period of transformation, driven by both economic pressures and technological advancements. While the sector has faced challenges such as fluctuating commodity prices and regulatory changes, it remains a vital part of the national economy. The government has implemented various policies aimed at revitalizing the industry, encouraging investment, and promoting sustainable practices. As a result, there is a renewed interest in mining operations, particularly among foreign investors looking to capitalize on South Africa’s rich mineral resources.

In recent years, the industry has also seen a shift towards more sustainable mining practices, with companies increasingly adopting technologies that minimize environmental impact. This focus on sustainability is not only beneficial for the environment but also enhances the long-term viability of mining operations. As a result, many mines are now being evaluated for their potential to meet both economic and environmental standards, making them more attractive to potential buyers.

Furthermore, the ongoing global demand for minerals, particularly in sectors such as renewable energy and electric vehicles, has created new opportunities for growth within the South African mining industry. As the world transitions towards greener technologies, the demand for specific minerals, such as lithium and cobalt, is expected to rise. This shift presents a unique opportunity for investors looking to acquire mines that can supply these critical resources.

As of now, there are several mines available for sale in South Africa, catering to a range of investment interests. These mines vary in size, mineral output, and operational status, providing potential buyers with diverse options. Some of the most sought-after mines include those producing gold, platinum, and coal, which remain in high demand both locally and internationally. The availability of these mines presents a unique opportunity for investors looking to enter the South African mining market.

In addition to traditional mineral resources, there is also a growing interest in mines that focus on rare earth elements and other strategic minerals. These mines are becoming increasingly valuable due to their applications in high-tech industries and renewable energy technologies. Investors are encouraged to conduct thorough research and due diligence to identify mines that align with their investment goals and risk tolerance.

For those interested in purchasing a mine, it is essential to work with experienced brokers and industry experts who can provide insights into the current market landscape. These professionals can help navigate the complexities of mine sales, ensuring that buyers are well-informed about the potential risks and rewards associated with their investment.

Several key factors influence the sale of mines in South Africa, including economic conditions, regulatory frameworks, and market demand. Economic stability plays a crucial role in determining the attractiveness of mining investments. When the economy is strong, demand for minerals typically increases, leading to higher valuations for mines. Conversely, economic downturns can result in decreased demand and lower prices, making it more challenging for sellers to find buyers.

Regulatory frameworks also significantly impact mine sales. The South African government has implemented various policies aimed at promoting investment in the mining sector, but navigating these regulations can be complex. Potential buyers must be aware of the legal requirements associated with mine ownership, including environmental regulations, labor laws, and licensing processes. Understanding these factors is essential for making informed investment decisions.

Market demand for specific minerals is another critical factor influencing mine sales. As global trends shift towards renewable energy and sustainable technologies, the demand for certain minerals is expected to rise. Investors should consider the long-term viability of the minerals produced by the mines they are interested in, as this will ultimately impact the potential return on investment. By staying informed about market trends and demand forecasts, buyers can make strategic decisions that align with their investment objectives.

Navigating the mine purchase process in South Africa requires careful planning and a thorough understanding of the industry. The first step for potential buyers is to conduct comprehensive research on available mines, including their operational status, mineral output, and financial performance. Engaging with industry experts and brokers can provide valuable insights and help identify suitable investment opportunities.

Once a potential mine has been identified, buyers should conduct due diligence to assess the mine’s value and potential risks. This process typically involves reviewing financial statements, environmental assessments, and legal documentation. It is crucial to understand any liabilities associated with the mine, such as outstanding debts or regulatory compliance issues. A thorough due diligence process can help mitigate risks and ensure a successful transaction.

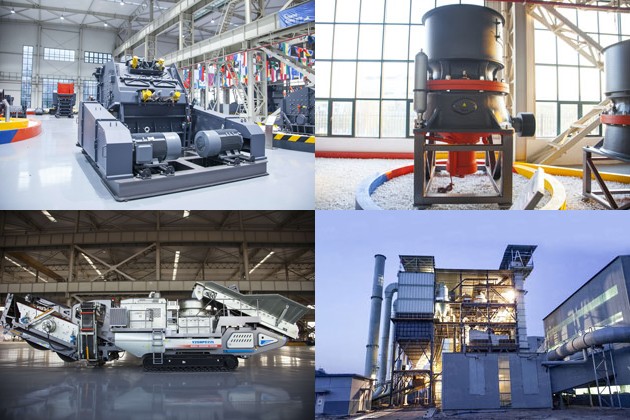

Finally, buyers should be prepared to negotiate the terms of the sale, including the purchase price, payment structure, and any contingencies. Working with legal and financial advisors can help facilitate this process and ensure that all parties are aligned on the terms of the agreement. Additionally, potential buyers should consider the importance of investing in high-quality equipment to support their mining operations. SBM Company offers a range of crushers, mills, and other heavy industrial equipment that can enhance operational efficiency and productivity, making it a valuable partner for any mining venture.

In conclusion, the South African mining industry presents a wealth of opportunities for investors interested in acquiring mines. With a diverse range of available mines, a focus on sustainability, and a growing demand for minerals, now is an opportune time to explore potential investments. By understanding the current state of the industry, key factors influencing mine sales, and the process of purchasing a mine, investors can make informed decisions that align with their goals. Additionally, partnering with reputable equipment suppliers like SBM Company can further enhance the success of mining operations, ensuring that investors are well-equipped to navigate the challenges and opportunities within this dynamic sector.

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE