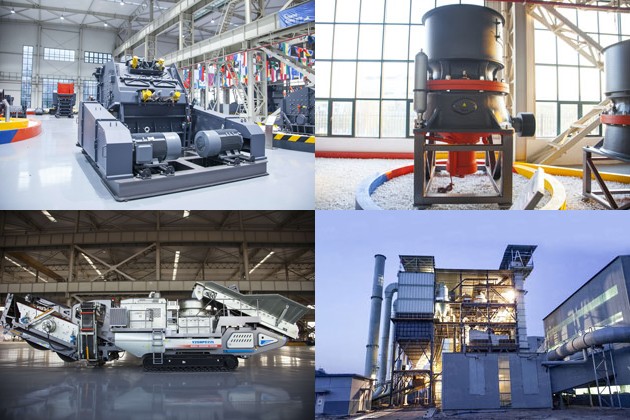

In the highly competitive field of gold mining, understanding the true cost of operating a 100 tons per day (TPD) gold mill is critical for maximizing profitability and ensuring long-term sustainability. The financial landscape of a gold mill is influenced by a variety of factors, including capital expenditures, operational costs, and external influences such as market dynamics and regulatory requirements. As a trusted partner in the mining industry, Sbm Company offers a range of robust crushers, mills, and heavy industrial equipment tailored to optimize the operations of gold mills.

By assessing the key components that contribute to the true cost of a 100 TPD gold mill, stakeholders can make informed decisions regarding resource allocation and operational strategies. Our state-of-the-art products, like the Sbm series of grinding mills and crushers, are designed to enhance efficiency and lower operational costs, ensuring that mining operations remain profitable even in fluctuating market conditions.

Capital expenditures represent the upfront investment required to establish and equip a gold mill. This includes the cost of land acquisition, construction of the mill, and purchasing necessary machinery and equipment. Specifically, for a 100 TPD gold mill, these costs can be substantial and are influenced by factors such as the quality of equipment, technology used, and geographical location. The choice of high-quality, durable machines, like those offered by Sbm, can significantly reduce future maintenance costs and enhance the mill’s operational lifespan.

In addition, factors such as site preparation and infrastructure development also contribute to capital expenditures. For example, building access roads, water supply systems, and electrical connections can add to the initial costs. Choosing efficient crushers and mills from Sbm can streamline the setup process and minimize unexpected expenses, thereby ensuring that the overall capital expenditure aligns effectively with budgetary constraints.

Once a gold mill is established, ongoing operational costs become a primary concern. These costs include labor, maintenance, energy consumption, and the costs associated with sourcing raw materials. Labor costs can vary based on region, the availability of skilled workers, and the effectiveness of training programs. The choice of equipment plays a pivotal role in this context—investing in advanced technology, such as Sbm’s high-efficiency milling solutions, can reduce energy consumption and increase production rates, effectively lowering the operational cost per ounce of gold produced.

Moreover, production efficiency is crucial for ensuring that the mill operates at optimal levels. Factors that can influence efficiency include the quality of the ore being processed, the throughput capacity of the equipment, and the effectiveness of the operational management strategies in place. Utilizing Sbm’s innovative solutions not only helps in enhancing production efficiency but also aids in minimizing downtime, thus ensuring that the mill consistently meets its 100 TPD target.

External factors can significantly impact the financial performance of a gold mill. Market dynamics, such as fluctuations in gold prices and competition among mining operations, play a significant role in determining the profitability of a 100 TPD gold mill. Additionally, regulatory requirements and environmental assessments can add further financial burdens, necessitating compliance costs that need to be factored into the overall cost structure. Staying informed about market trends and regulatory changes is vital for maintaining a competitive edge in the industry.

Moreover, geopolitical factors and international trade policies can influence the cost of imported equipment and raw materials. By strategically investing in local suppliers and utilizing Sbm’s domestic heavy equipment solutions, gold mill operators can mitigate some of the risks associated with external fluctuations. A thorough evaluation of these external influences, combined with the right technological investments, can ultimately lead to better financial resilience and profitability in gold mill operations.

In conclusion, the true cost of operating a 100 TPD gold mill is a multifaceted issue influenced by capital expenditures, operational costs, and external market conditions. Companies such as Sbm are committed to providing high-performance equipment that can help mining operations optimize their investment and enhance productivity. From durable crushers to advanced grinding mills, our products are designed to meet the specific needs of gold mill operators, ultimately aiding them in reducing costs and maximizing efficiency. By carefully evaluating all cost determinants and aligning with reliable partners, stakeholders can ensure a profitable future in the gold mining industry.

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE