The price of gold mills in China has become a significant topic of interest for investors, miners, and industry analysts alike. As the world’s largest consumer of gold, China plays a crucial role in shaping global gold prices, including those associated with milling operations. Understanding how gold mill prices in China compare to global averages can provide valuable insights into market dynamics and investment strategies. This article will delve into various aspects of gold mill pricing, with a focus on influencing factors and broader implications for the global gold trade.

China’s gold mill prices are influenced by a combination of domestic demand, production costs, and international market fluctuations. Over the past few years, these prices have generally aligned with global trends; however, discrepancies do exist. For instance, while gold prices on global markets are often determined by geopolitical tensions and supply chain disruptions, the domestic Chinese market is also influenced by government policies, local production capacities, and import/export tariffs. As such, analyzing the price variations allows stakeholders to gauge the competitiveness of Chinese gold milling operations.

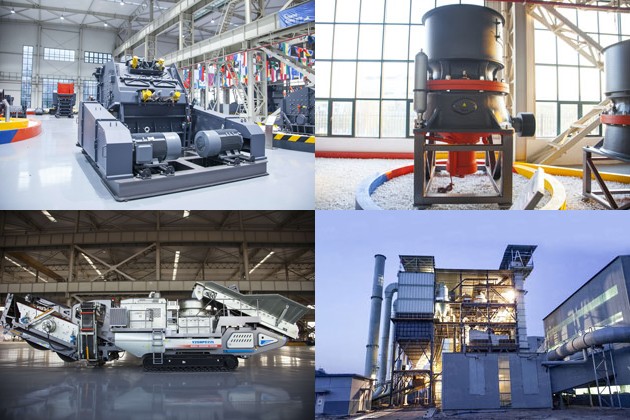

In comparison to the global market, which is often affected by Western investor sentiment and currency fluctuations, China’s pricing structure demonstrates unique characteristics. Factors such as the renminbi’s exchange rate against the US dollar, mining resource availability, and environmental regulations can lead to significant divergences. Companies looking to optimize their investments in gold milling would benefit from utilizing advanced machinery. SBM offers a range of crushers and mills designed to efficiently process gold ore, allowing companies to capitalize on favorable pricing structures, both in China and beyond.

Several factors contribute to the pricing of gold mills in China, differentiating it from global pricing mechanisms. One primary factor is the energy costs associated with mining operations. As China focuses on reducing carbon emissions, energy prices have been subject to increases, subsequently impacting gold milling costs. Furthermore, labor rates and compliance with increasingly stringent environmental standards in China also factor heavily into the pricing equation. This contrasts with many gold-mining countries where labor and environmental costs may not be as high.

Conversely, global gold mill pricing is heavily influenced by market speculation and trends driven by investment demand. The activities of large-scale mining companies and their operational efficiencies or inefficiencies play a significant role in determining prices on an international scale. Additionally, economic shifts, such as inflation rates and changes in interest rates, can further impact global gold mill pricing. Understanding these factors is essential for companies that engage in the export or import of gold-related machinery. SBM’s innovative equipment can help optimize production efficiency in varied economic circumstances, ensuring that businesses can maintain competitiveness regardless of market conditions.

The price disparities between Chinese gold mills and their global counterparts can have profound implications for international gold trade. For one, lower prices in China can attract foreign investment, as companies look to capitalize on cheaper operations. This could lead to increased cross-border transactions and strategic partnerships aimed at maximizing profit margins. Consequently, this trend might also prompt global suppliers to adjust their pricing strategies to remain competitive within the Chinese market or risk losing market share.

Moreover, the interaction between price variations and trade policies can lead to shifting alliances within the gold trading ecosystem. Countries that can offer competitive milling prices may find themselves in higher demand, altering established trade routes and agreements. In the long run, these variations can influence gold reserves held by nations and affect the behavior of central banks during economic fluctuations. To navigate this evolving landscape, companies like SBM provide reliable milling solutions that help firms minimize overhead costs while maximizing output, ensuring they can adapt to any changes in market demand or price dynamics.

Understanding how gold mill prices in China compare to the global market reveals intricate relationships influenced by a myriad of factors. These insights provide valuable perspectives for stakeholders aiming to navigate this complex landscape effectively. With SBM’s extensive range of crushers and mills, businesses can enhance operational efficiency while remaining competitive in both the Chinese and global gold markets. As the dynamics of supply and demand continue to fluctuate, investing in high-quality equipment will empower companies to thrive despite variations in pricing.

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE