In the competitive landscape of the construction and mining industries, securing financing for a stone crusher project is crucial for success. A comprehensive bank loan project report serves as a vital tool for entrepreneurs and businesses seeking to obtain funding for their operations. This report not only outlines the technical and financial aspects of the project but also demonstrates the viability and profitability of the investment to potential lenders. As a leading provider of crushers, mills, and other heavy industrial equipment, Sbm Company understands the importance of a well-prepared project report and offers a range of products that can enhance the efficiency and productivity of stone crushing operations.

Creating a detailed project report is essential for establishing credibility with financial institutions. It provides a structured approach to presenting your business idea, showcasing your understanding of the market, and highlighting the potential return on investment. By effectively communicating your project’s objectives, methodologies, and financial forecasts, you can significantly increase your chances of securing the necessary funding. In this article, we will explore the key elements of a comprehensive bank loan project report specifically tailored for a stone crusher operation, along with practical tips for conducting feasibility studies and presenting financial projections.

A bank loan project report is a critical document that outlines the specifics of a proposed business venture, including its objectives, operational plans, and financial projections. For a stone crusher project, this report serves as a roadmap that guides the entrepreneur through the various stages of project development while also providing lenders with the necessary information to assess the viability of the investment. By detailing the market demand for crushed stone, the competitive landscape, and the operational requirements, the report helps to establish a compelling case for financing.

Moreover, a well-structured project report enhances the credibility of the business owner in the eyes of potential lenders. It demonstrates a thorough understanding of the industry, the challenges involved, and the strategies in place to mitigate risks. This level of professionalism can significantly influence a bank’s decision to approve a loan, as it reflects the entrepreneur’s commitment to the project and their ability to manage it effectively. Sbm Company’s extensive experience in the heavy equipment sector positions it as a valuable partner in preparing such reports, offering insights into the latest technologies and market trends that can bolster your proposal.

When preparing a bank loan project report for a stone crusher, several key components must be included to ensure comprehensiveness and clarity. First and foremost, an executive summary should provide a concise overview of the project, including its objectives, the type of stone to be crushed, and the anticipated market demand. This section sets the tone for the entire report and should capture the reader’s attention while summarizing the essential details of the project.

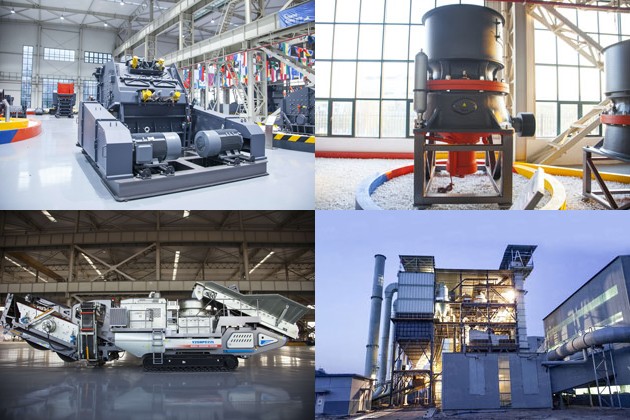

In addition to the executive summary, the report should include a detailed description of the operational plan, which outlines the machinery and equipment required for the stone crushing process. This is where Sbm Company’s products come into play, as they offer a range of high-quality crushers and mills designed to optimize performance and efficiency. Including specifications, costs, and potential suppliers in this section will provide lenders with a clear understanding of the operational requirements and the investment needed to launch the project successfully.

Conducting a feasibility study is a crucial step in preparing a bank loan project report, as it assesses the practicality and potential success of the stone crushing venture. The first step involves analyzing the market demand for crushed stone in the target area. This includes researching local construction projects, infrastructure developments, and the overall economic climate. Understanding the competitive landscape and identifying potential customers will help to establish a solid foundation for the project.

Next, the feasibility study should evaluate the technical aspects of the operation, including site selection, equipment requirements, and production capacity. This is where Sbm Company’s expertise can be invaluable, as they provide advanced crushing solutions tailored to meet specific project needs. By assessing the availability of raw materials, transportation logistics, and regulatory compliance, the feasibility study will provide a comprehensive overview of the project’s viability, enabling informed decision-making and enhancing the credibility of the project report.

Financial projections are a critical component of any bank loan project report, as they provide lenders with insight into the expected profitability and cash flow of the stone crushing operation. To present these projections effectively, it is essential to use clear and concise financial statements, including profit and loss statements, cash flow forecasts, and balance sheets. These documents should be based on realistic assumptions and supported by thorough market research and historical data.

Additionally, it is beneficial to include a break-even analysis, which outlines the point at which the project will become profitable. This analysis helps lenders understand the risks involved and the timeline for achieving financial stability. Sbm Company recommends utilizing advanced financial modeling tools to create accurate projections that reflect the potential of your stone crushing operation. By presenting well-researched and clearly articulated financial projections, you can instill confidence in potential lenders and increase your chances of securing the necessary funding.

In conclusion, preparing a comprehensive bank loan project report for a stone crusher is a multifaceted process that requires careful planning, research, and presentation. By understanding the importance of the report, including key components, conducting thorough feasibility studies, and presenting financial projections effectively, entrepreneurs can significantly enhance their chances of obtaining financing. Sbm Company stands ready to support your stone crushing venture with high-quality equipment and expert guidance, ensuring that your project report not only meets the expectations of lenders but also positions your business for long-term success in the competitive market.

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE