“`markdown

The gravel industry plays a crucial role in construction and infrastructure development, providing essential materials for various projects. For entrepreneurs and investors looking to enter this sector, buying a gravel company can be a lucrative opportunity. However, it requires a thorough understanding of the industry, careful evaluation of potential companies, and consideration of financial and legal aspects. This article aims to guide prospective buyers through these critical areas, ensuring they make informed decisions. Additionally, we at Sbm Company offer a range of crushers, mills, and heavy industrial equipment that can enhance the operational efficiency of any gravel business.

The gravel industry is characterized by its diverse applications, ranging from road construction to landscaping and concrete production. Understanding the market dynamics, including demand fluctuations and regional supply chains, is essential for any potential buyer. Buyers should familiarize themselves with the types of gravel products available, such as crushed stone, sand, and decorative gravel, as well as the specific machinery and processes involved in their production. This knowledge will help buyers identify opportunities and challenges within the industry.

Moreover, the gravel market is influenced by various factors, including economic conditions, infrastructure spending, and environmental regulations. Buyers should stay informed about industry trends, such as the increasing focus on sustainable practices and the use of recycled materials. By understanding these key insights, prospective buyers can better position themselves to make strategic decisions when considering the acquisition of a gravel company.

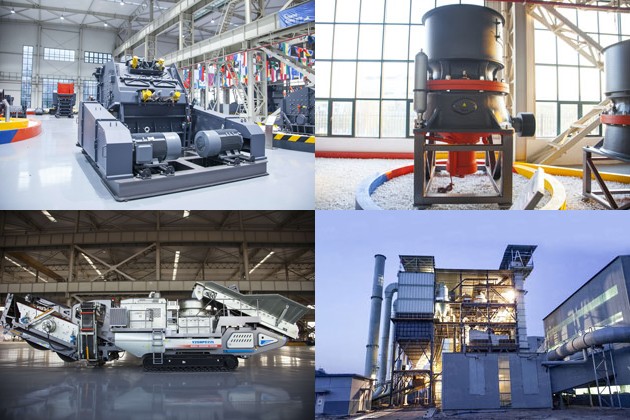

When evaluating potential gravel companies for acquisition, several critical factors must be considered. First, buyers should assess the company’s operational capabilities, including the quality of its equipment, production capacity, and workforce expertise. A thorough inspection of the company’s facilities and machinery, including crushers and mills, is essential to determine their condition and efficiency. Sbm Company offers a variety of high-performance crushers and mills that can significantly enhance production capabilities, making them an excellent choice for any gravel operation.

Additionally, buyers should analyze the company’s financial health, including revenue trends, profit margins, and outstanding debts. Reviewing financial statements and conducting due diligence will provide insights into the company’s profitability and potential for growth. Understanding the customer base and market position of the gravel company is also crucial, as it can indicate the stability and future prospects of the business. By carefully evaluating these factors, buyers can make informed decisions about which gravel companies align with their investment goals.

Acquiring a gravel company involves various financial considerations that can significantly impact the overall investment. Buyers should be prepared to assess the purchase price in relation to the company’s assets, liabilities, and market value. Conducting a comprehensive valuation of the business, including tangible assets like equipment and intangible assets such as brand reputation, is essential for determining a fair price. Sbm Company’s equipment, known for its durability and efficiency, can add significant value to a gravel operation, making it a worthwhile consideration during the acquisition process.

Financing the acquisition is another critical aspect to consider. Buyers may explore various funding options, including traditional bank loans, private equity, or seller financing. Understanding the implications of each financing method, including interest rates and repayment terms, is vital for ensuring the long-term viability of the investment. Additionally, buyers should account for ongoing operational costs, such as maintenance, labor, and regulatory compliance, to develop a comprehensive financial plan that supports the successful operation of the gravel company post-acquisition.

Navigating the legal landscape is a crucial step in the process of acquiring a gravel company. Buyers must ensure that the company complies with all local, state, and federal regulations, including environmental laws and zoning requirements. Conducting thorough due diligence is essential to identify any potential legal issues that could arise post-acquisition. This may involve reviewing permits, licenses, and any existing contracts with suppliers or customers. Engaging legal counsel with expertise in the gravel industry can provide valuable guidance throughout this process.

Additionally, buyers should be aware of the implications of transferring ownership, including any liabilities that may be inherited from the previous owner. Understanding the legal framework surrounding the acquisition will help buyers mitigate risks and ensure a smooth transition. It is also important to consider any potential litigation or disputes that may affect the company’s operations. By proactively addressing these legal requirements, buyers can safeguard their investment and position themselves for success in the gravel industry.

In conclusion, buying a gravel company presents a unique opportunity for investors and entrepreneurs looking to enter a vital sector of the economy. By understanding the gravel industry, carefully evaluating potential companies, considering financial aspects, and navigating legal requirements, buyers can make informed decisions that lead to successful acquisitions. Sbm Company is committed to supporting gravel businesses with our high-quality crushers, mills, and heavy industrial equipment, ensuring that your investment is backed by reliable and efficient machinery. With the right approach and resources, entering the gravel industry can be a rewarding venture.

“`

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE