In the rapidly evolving industrial landscape of Pakistan, the demand for efficient and cost-effective machinery is on the rise. Among the various options available, ball mills have emerged as a crucial component in the processing of minerals and materials. As a leading provider of heavy industrial equipment, Sbm Company recognizes the importance of conducting a thorough feasibility study before investing in ball mill projects. This article delves into the economic viability of ball mills in Pakistan, the key factors influencing investment decisions, and the potential returns and risks associated with such projects.

The economic viability of ball mills in Pakistan hinges on several critical factors, including the availability of raw materials, market demand, and operational costs. With Pakistan’s rich mineral resources, such as coal, limestone, and gypsum, the potential for utilizing ball mills in processing these materials is significant. A feasibility study can help identify the most suitable locations for establishing ball mills, ensuring that raw materials are readily accessible and transportation costs are minimized.

Moreover, the growing construction and manufacturing sectors in Pakistan have led to an increased demand for high-quality materials. This demand creates a favorable market environment for ball mills, which are essential for producing finely ground materials. By conducting a feasibility study, investors can assess the market dynamics and determine whether the projected demand justifies the investment in ball mill technology.

Additionally, operational costs play a vital role in evaluating the economic viability of ball mills. Factors such as energy consumption, maintenance expenses, and labor costs must be analyzed to ensure that the investment remains profitable. Sbm Company offers advanced ball mill solutions designed for energy efficiency and reduced operational costs, making them an attractive option for investors looking to maximize their returns.

Several key factors influence investment decisions regarding ball mills in Pakistan. One of the most significant factors is the regulatory environment, which can impact the ease of doing business and the overall investment climate. Understanding the local regulations, permits, and compliance requirements is essential for investors to navigate potential challenges and ensure a smooth project implementation.

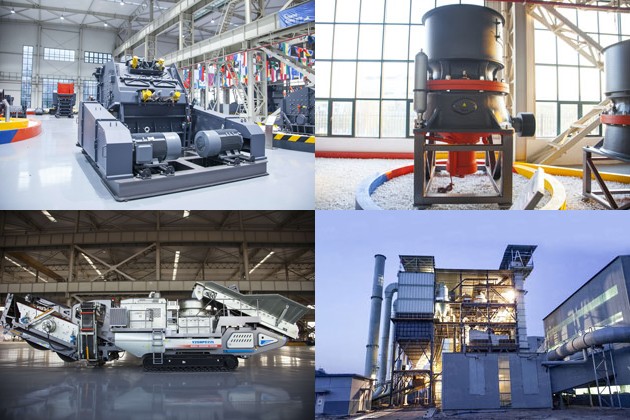

Another critical factor is the technological advancements in ball mill design and operation. Sbm Company is at the forefront of innovation, providing state-of-the-art ball mills that enhance productivity and efficiency. Investors should consider the latest technologies available in the market, as these can significantly affect the performance and longevity of the equipment, ultimately influencing the return on investment.

Furthermore, the availability of skilled labor is a crucial consideration for investors. The successful operation of ball mills requires trained personnel who can manage and maintain the equipment effectively. By assessing the local labor market and investing in training programs, companies can ensure that they have the necessary workforce to operate their ball mills efficiently, thereby reducing downtime and increasing productivity.

Investing in ball mill projects in Pakistan presents the potential for substantial returns, particularly in light of the country’s growing industrial sector. By producing high-quality materials, companies can tap into lucrative markets both domestically and internationally. A well-executed feasibility study can provide insights into pricing strategies and market entry points, enabling investors to maximize their profits.

However, like any investment, there are inherent risks associated with ball mill projects. Fluctuations in raw material prices, changes in market demand, and unforeseen operational challenges can impact profitability. Conducting a comprehensive feasibility study helps identify these risks and develop mitigation strategies, ensuring that investors are well-prepared to navigate potential obstacles.

Additionally, the initial capital investment required for ball mills can be significant. Investors must weigh the upfront costs against the projected returns to determine the feasibility of the project. Sbm Company offers competitive financing options and tailored solutions to help investors manage their capital expenditures effectively, making it easier to embark on ball mill projects with confidence.

In conclusion, a ball mill feasibility study in Pakistan can be a worthwhile investment, provided that thorough research and analysis are conducted. By evaluating the economic viability, understanding key influencing factors, and assessing potential returns and risks, investors can make informed decisions that align with their business objectives. Sbm Company stands ready to support these endeavors with advanced ball mill technology and expertise, ensuring that investors can capitalize on the opportunities presented by the growing industrial landscape in Pakistan.

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE