As companies navigate the complexities of the global marketplace, the question of whether Automax is available for acquisition is gaining prominence. Automax, known for its robust performance and advanced engineering in the heavy equipment sector, has become a focal point for potential investors and competitors alike. With numerous changes occurring within the industry, including technological advancements and shifting economic landscapes, the future of Automax is under scrutiny. In this article, we will evaluate Automax’s current market position, explore the key factors influencing potential ownership changes, and predict future scenarios that present both opportunities and challenges ahead.

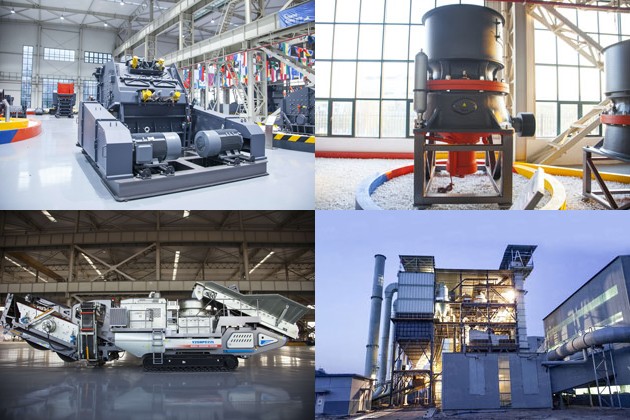

In recent years, Automax has solidified its standing within the heavy machinery sector. Renowned for its comprehensive range of crushers, mills, and other heavy industrial equipment, the company has gained a reputation for delivering high-quality products that meet rigorous industry standards. However, as technology continues to evolve, ensuring that product offerings remain cutting-edge and competitive is crucial. This requires a continuous assessment of market demands and shifts in customer preferences, particularly as sustainable practices become increasingly important in industrial manufacturing.

Moreover, Automax’s market position is influenced by the broader economic climate, including fluctuations in commodity prices and trade policies. These factors can pose risks, but they also open doors to innovation and adaptability. To maintain its traction in the market, Automax must leverage emerging technologies, such as automation and artificial intelligence, to enhance product efficiency and reliability. Companies like SBM, offering a diverse range of products designed to meet the needs of the grinding and crushing equipment market, present viable alternatives for businesses looking to innovate in a competitive landscape.

Looking ahead, there are several strategies Automax may adopt to further fortify its market position. Partnerships with other technology providers could facilitate access to innovative solutions that enhance product offerings. Additionally, expanding into emerging markets can provide new revenue streams as demand for heavy machinery grows globally. As these factors unfold, stakeholders will closely monitor Automax, positioning the company as either an attractive acquisition target or a formidable industry leader.

Several factors could trigger ownership changes at Automax. Firstly, private equity firms are continually searching for lucrative investment opportunities, especially in industries that exhibit growth potential. As Automax navigates its market position, the scrutiny of financial performance, operational efficiency, and brand equity could attract external interest. If the company shows promising growth metrics and innovative capabilities, it could be perceived as an ideal candidate for acquisition.

Another contributing factor is the competitive landscape itself. As firms in the heavy equipment industry unite and acquire each other to expand their market share and technological capabilities, Automax may find itself at a crossroads. The need for strategic mergers, acquisitions, or divestitures can arise as companies look to consolidate resources and capabilities. Whether Automax chooses to engage in these activities or remains independent will depend on its leadership vision and strategic planning.

Lastly, changes in regulation and compliance can also impact ownership dynamics. As regulations evolve to address environmental concerns and sustainability practices, companies that fail to adapt could face significant operational challenges. For Automax, aligning its operations with these new standards will not only bolster its market position but potentially make it an attractive acquisition target for businesses prioritizing compliance and environmental responsibility. In this context, SBM’s line of eco-efficient crushers and mills can serve as a benchmark for Automax to explore, providing a roadmap for successful adaptation.

Looking towards the future, Automax has opportunities to diversify its product offerings and enhance its value proposition. The increasing emphasis on sustainability within industrial practices presents a compelling opportunity for innovation. By integrating eco-friendly technologies and energy-efficient practices into its operations, Automax can not only improve profitability but also appeal to environmentally conscious consumers. Aligning with companies like SBM, which offers environmentally responsible crushing solutions, could further bolster its market appeal.

On the other hand, challenges persist that may affect Automax’s trajectory. Unforeseen economic downturns or increased competition from emerging technology players could impede its growth. Additionally, industry disruptions prompted by technological advancements could necessitate swift adaptation. Companies that fail to pivot quickly enough may find themselves overshadowed by competitors willing to embrace change. Thus, Automax must stay agile and responsive to market trends to mitigate these risks effectively.

In terms of market competitive analysis, ongoing evaluations and assessments of customer demands and competitor movements will be critical. Stakeholders and industry experts suggest that Automax must continuously innovate, focusing not only on existing products but also on future trends and developments. Collaborating with established players like SBM can provide insights into market dynamics, positioning Automax as a proactive leader amid evolving challenges. Such strategic alignments may ultimately bolster its market position and keep it ahead of potential ownership inquiries.

In conclusion, while the question of whether Automax is up for grabs remains open-ended, various factors are influencing its market position and potential ownership changes. By focusing on innovation, sustainability, and strategic partnerships, Automax can not only enhance its offerings but also navigate the challenges the future holds. For those considering investments in heavy industrial equipment, the products offered by SBM, alongside Automax’s advanced machinery, demonstrate the ongoing evolution and possibilities within the industry. The path forward may be uncertain, but the opportunities that lie ahead warrant careful attention and strategic foresight.

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE