In the competitive landscape of the construction and mining industries, acquiring the right equipment is crucial for success. For businesses looking to invest in stone crushers, securing financing can be a significant hurdle. The State Bank of India (SBI) offers various loan options tailored to meet the needs of entrepreneurs in this sector. This article will guide you through the process of obtaining an SBI loan specifically for purchasing stone crushers, while also highlighting the quality products offered by SBM, a leading manufacturer of crushers and other heavy industrial equipment.

SBI provides a range of loan products designed to support small and medium enterprises (SMEs) in the construction and mining sectors. These loans can be utilized for purchasing stone crushers, which are essential for processing raw materials into aggregates. The bank offers both term loans and working capital loans, allowing businesses to choose the financing option that best suits their operational needs. Term loans are typically used for capital expenditures, while working capital loans can help manage day-to-day operational costs.

In addition to traditional loans, SBI also offers specialized schemes for MSMEs (Micro, Small, and Medium Enterprises) that may include lower interest rates and extended repayment periods. These schemes are designed to promote entrepreneurship and support the growth of small businesses in the stone crushing industry. Understanding the various loan options available is crucial for making an informed decision that aligns with your business goals.

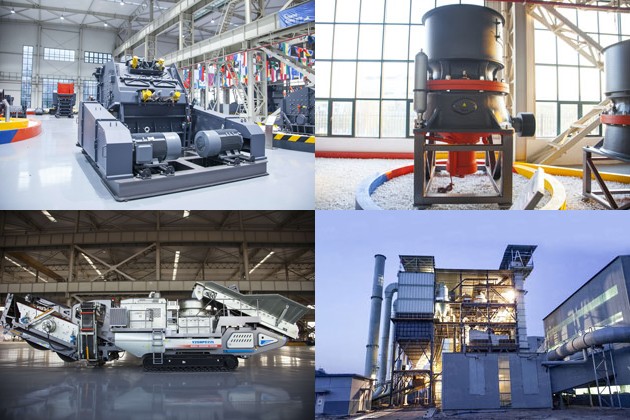

Furthermore, it is essential to consider the specific requirements of your stone crushing business when selecting a loan product. Factors such as the scale of operations, projected revenue, and the type of equipment needed will influence your choice. SBM offers a wide range of stone crushers, including jaw crushers, cone crushers, and impact crushers, which can cater to different operational needs. By investing in high-quality equipment from SBM, you can enhance productivity and ensure a solid return on your investment.

To qualify for an SBI loan, applicants must meet certain eligibility criteria set by the bank. Generally, the primary requirements include being a registered business entity, having a sound business plan, and demonstrating the ability to repay the loan. For stone crusher businesses, it is crucial to provide detailed information about the intended use of the loan, including the type of equipment to be purchased and the expected revenue generation.

Additionally, SBI may require applicants to submit financial statements, tax returns, and other documentation that reflects the financial health of the business. A good credit score is also an important factor in determining eligibility, as it indicates the applicant’s creditworthiness and ability to manage debt. Businesses with a strong financial history and a clear repayment plan are more likely to secure favorable loan terms.

Moreover, collateral may be required to secure the loan, which can include the equipment being purchased or other assets owned by the business. This requirement helps mitigate the bank’s risk and ensures that borrowers are committed to repaying the loan. By understanding these eligibility criteria, stone crusher businesses can better prepare their applications and increase their chances of approval.

The application process for obtaining an SBI loan involves several key steps that applicants must follow to ensure a smooth experience. First, it is essential to gather all necessary documentation, including business registration certificates, financial statements, and a detailed project report outlining the intended use of the loan. This report should include information about the stone crusher equipment being purchased, projected cash flows, and the overall business strategy.

Once the documentation is prepared, applicants can visit their nearest SBI branch or apply online through the bank’s official website. During the application process, it is crucial to provide accurate and complete information to avoid delays or rejections. The bank’s representatives will review the application and may request additional information or clarification regarding the business plan and financial projections.

After the application is submitted, SBI will conduct a thorough assessment of the business’s financial health and the viability of the proposed project. This may involve site visits and discussions with the business owner to better understand the operations. Once the assessment is complete, the bank will communicate its decision, and if approved, the loan amount will be disbursed as per the agreed terms. It is advisable to maintain open communication with the bank throughout this process to address any concerns promptly.

Securing an SBI loan for a stone crusher business requires careful planning and preparation. One of the most effective tips is to create a comprehensive business plan that outlines your objectives, market analysis, and financial projections. A well-structured business plan demonstrates to the bank that you have a clear vision for your business and a strategy for achieving profitability. This can significantly enhance your chances of loan approval.

Another important tip is to maintain a good credit score by managing existing debts responsibly. Before applying for the loan, review your credit report and address any discrepancies or outstanding issues. A strong credit history not only improves your eligibility but can also lead to more favorable loan terms, such as lower interest rates and longer repayment periods.

Lastly, consider seeking advice from financial experts or consultants who specialize in loan applications for SMEs. They can provide valuable insights into the application process and help you prepare the necessary documentation. Additionally, exploring the range of stone crushers offered by SBM can help you make informed decisions about the equipment you need, further strengthening your loan application by demonstrating a clear plan for investment.

In conclusion, obtaining an SBI loan for a stone crusher business involves understanding the available loan options, meeting eligibility criteria, and following a structured application process. By preparing a solid business plan and maintaining a good credit score, you can enhance your chances of securing financing. Investing in high-quality stone crushers from SBM can further support your business’s growth and operational efficiency. With the right preparation and resources, you can successfully navigate the loan application process and take your stone crushing business to new heights.

Discover whether bauxite crushers in Tanzania are the ideal choice for your crushing needs. Explore key features, advantages, and compare options, including SBM’s bauxite crushers Tanzania crusher for sale, tailored to optimize your bauxite processing operations.

View More

Discover the benefits of a mini crusher plant and learn key considerations for choosing the right machine crusher for sale. Explore how Sbm’s innovative solutions can meet your business needs efficiently and cost-effectively.

View More

Discover where to find the best brick machine for sale in Africa. Explore leading manufacturers, essential features to consider, and top marketplaces to maximize your investment in high-quality brick-making machinery.

View More

Discover the most reliable ball milling machine maker in our comprehensive article. We evaluate leading manufacturers, key features, customer reviews, and highlight SBM’s superior equipment for industrial applications. Optimize your milling processes today!

View MoreWe value your feedback! Please complete the form below so that we can tailor our services to your specific needs.

B6X Belt Conveyor adopts C-type steel as the main beam. It takes the modular structure and uses optimized headstock and tailstock. It is equipped with reversed V-type adjustable supporting legs. The whole machine is stable and compact and can be easily installed. It is an ideal upgrading and substitute product of traditional belt conveyor.

GET QUOTE